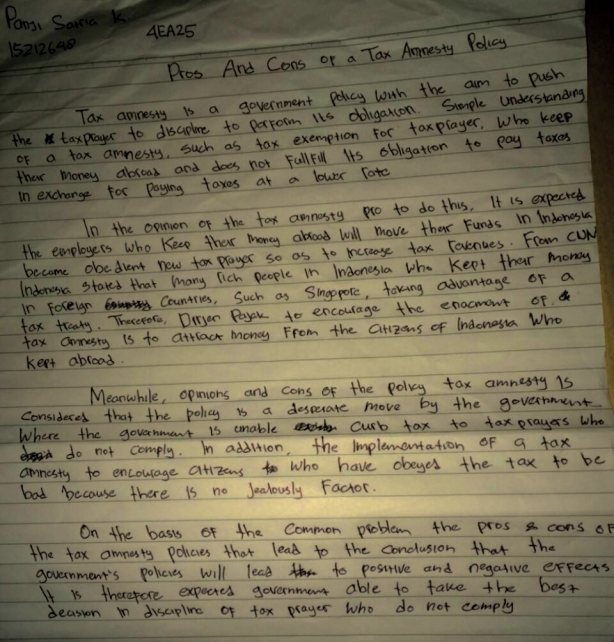

Tax amnesty is a government policy with the aim to invite the taxpayer to discipline to perform its obligations.Simple understanding of a tax amnesty, such as tax exemptions for taxpayers (WP) who kept their money abroad and does not fulfill its obligations to pay taxes in exchange for paying taxes at a lower rate.

In the opinion of the tax amnesty pro to do this, it is expected the employers who keep their money abroad will move their funds in Indonesia and became obedient new WP so as to increase tax revenues. From CNN Indonesia stated that many rich people in Indonesia who kept their money in foreign countries, such as Singapore, taking advantage of a tax treaty. Therefore, the Directorate General of Taxation (DGT) to encourage the enactment of tax amnesty is to attract money from the citizens of Indonesia who kept abroad

Meanwhile, opinions and cons of the tax amnesty is considered that the policy is a desperate move by the government. Where the government is unable to curb tax to taxpayers who do not comply. In addition, the implementation of a tax amnesty to encourage citizens who have obeyed the tax to be bad because there is no jealousy factor.

On the basis of the common problems the pros and cons of the tax amnesty policies that lead to the conclusion that the government’s policies will lead to positive and negative effects. It is therefore expected pemeritah able to take the best decision in the discipline of taxpayers who do not comply.